transfer taxes refinance georgia

Looking To Refinance Your Home Loan. The tax applies to realty.

10 Best Mortgage Lenders In Georgia Nextadvisor With Time

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

. ARTICLE 1 - REAL ESTATE TRANSFER TAX 48-6-1 - Transfer tax rate 48-6-2 - Exemption of certain instruments deeds or writings from real estate transfer tax. Georgia Title Insurance Rate Intangible Tax Calculator. The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed.

Ad Compare for the Best Home Refinance that Suits Your Needs with the Lowest Rates. Delaware DE Transfer Tax. Therefore no new deed transfer taxes are paid.

They calculate this tax on the loan amount of a mortgage which is like the real estate transfer tax levied in other. These regulations have been adopted by the Commissioner pursuant to OCGA. The closing of a real estate transaction in.

The Georgia intangibles tax is exempt on refinance transactions up to the amount of the unpaid balance on the original note. Purchasing a home in Georgia. Delaware DE Transfer Tax.

Ad Check out Our Refinance Loan Options Learn More at Quicken Loans. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. Refinance Mortgage Transfer Tax in Georgia.

In Georgia the average amount is 1897 for a 200000 mortgage. Rule 560-11-8-05 - Refinancing 1 Intangible recording tax is not required to be paid on that part of the face amount of a new instrument securing a long-term note secured by. Atlanta Title Company LLC 945 East Paces Ferry.

In Georgia the average amount is 1897 for a 200000 mortgage. Some areas do not have a county or local transfer tax rate. For the most part the rate is calculated per 100 500 or 1000.

Title Insurance 200 per thousand of loan amount. Sales Use Tax Policy Bulletins. The transfer tax is calculated as a percentage of the sale price or the appraised value of the property.

07th Sep 2010 0515 pm. I am refinancing my current mortgage and one of my potential lenders is stating that I need to a pay a mortgage transfer tax at closing. Seller Transfer Tax Calculator for State of Georgia.

This title calculator will. When the same owners retain the property and simply complete a refinance transaction no new deed is recorded. The percentage will vary depending on what the city county or state charges.

Atlanta Title Company LLC 1 404 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry Rd Resurgens Plaza Atlanta GA 30326. Easily estimate the title insurance premium and transfer tax in Georgia including the intangible mortgage tax stamps. Apply Today And Well Walk You Through The Process.

Title insurance rates will vary between title insurers in Georgia. If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. A property selling for 55000000 would incur a 55000 State of Georgia Transfer Tax.

Special Offers Just a Click Away. If the transfer tax is. In various jurisdictions transfer taxes are also called real estate conveyance taxes mortgage transfer.

Rule 560-11-8-05 - Refinancing 1 Intangible recording tax is not required to be paid on that part of the face amount of a new instrument securing a long-term note secured by real estate which represents a refinancing by the original lender and original borrower of. Refinance Mortgage Transfer Tax in Georgia. Title insurance is a closing cost for purchase and refinances mortgages.

In those areas the state transfer tax rate would. Subject 560-11-8 INTANGIBLE RECORDING TAX Rule 560-11-8-01 Purpose of Regulations. Sales Use Tax Regulations.

Georgia Transfer Tax 100 per thousand of sales price. The State of Delaware transfer tax rate is 250. Download Or Email Form PT-440 More Fillable Forms Register and Subscribe Now.

Georgia may have more current or accurate information. Intangible Tax 300 per thousand of the sales price. Ad It Costs 0 to Run the Numbers Recalculate Your New PaymentDont Wait Refinance Save.

Section 48-212 in order to promulgate specific policies and procedures of the Department applicable to the. Requirement that consideration be shown.

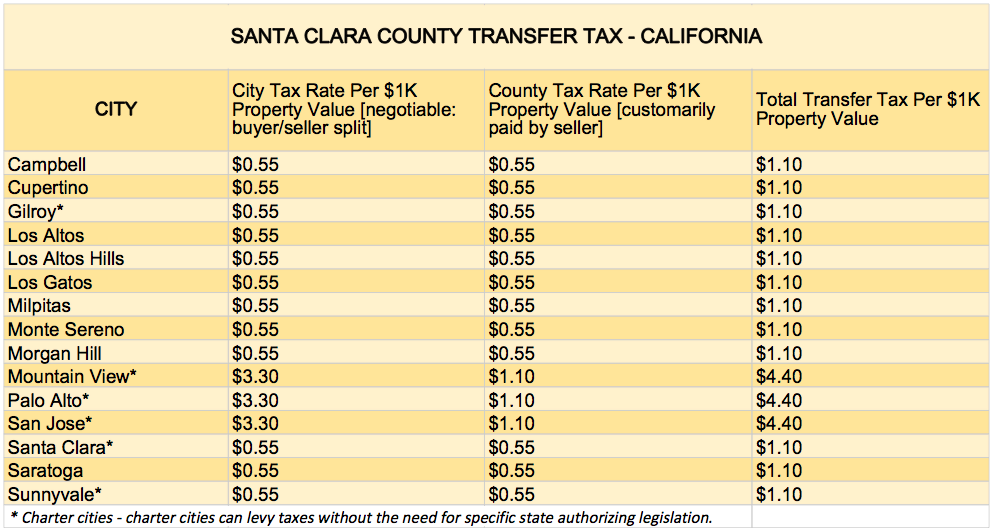

What You Should Know About Santa Clara County Transfer Tax

Georgia No Tax Return Bank Statement Mortgage Lenders

Attorney Refinance Closings Made Simple Georgia Closing Pro Title Escrow Llc

6 Mistakes To Avoid When Refinancing Your Home Georgia S Own

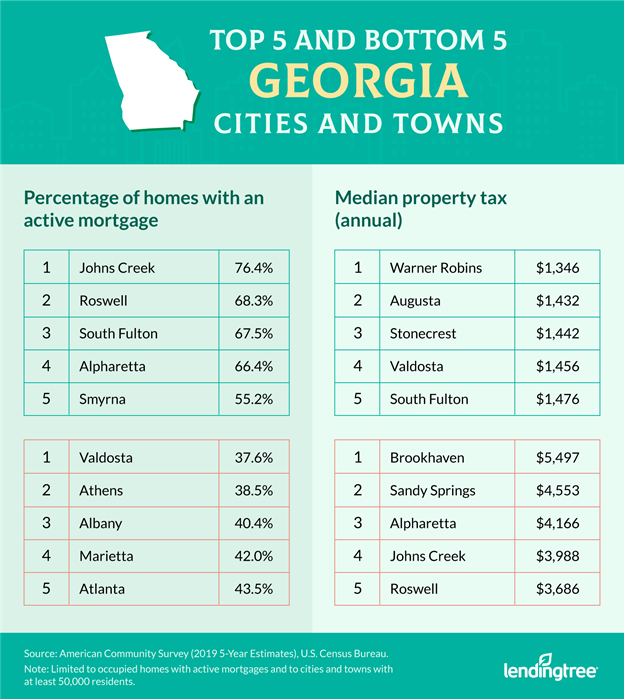

Dekalb County Ga Property Tax Calculator Smartasset

Motor Vehicles Forsyth County Tax

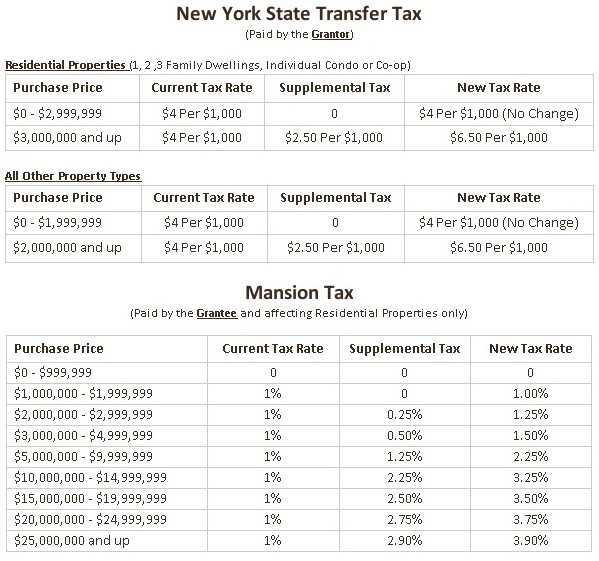

Real Property Transfer Tax Increase The Judicial Title Insurance Agency Llc

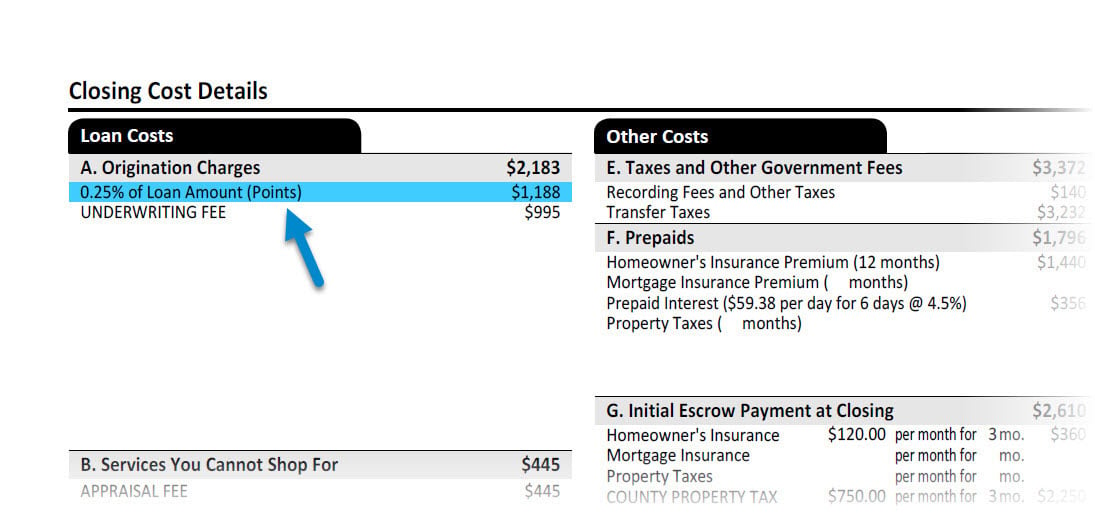

Should You Pay Mortgage Discount Points For A Lower Rate

Georgia Intangibles Tax Closingtoolbox Com

Mortgage Rates In Georgia Plus Stats

Georgia Estate Tax Everything You Need To Know Smartasset

Tennessee Real Estate Transfer Tax And Exemptions Tenn Code Ann 67 4 409 Nashville Commercial Real Estate Attorney

Closing Costs In Georgia Everything You Need To Know Faulkner Law

What Are The Costs Associated With Selling A Home In Georgia Brian M Douglas

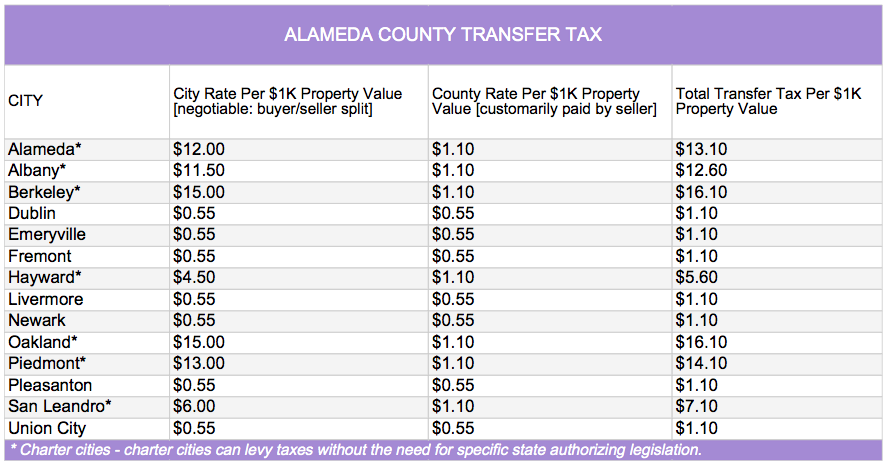

Transfer Tax Alameda County California Who Pays What

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro